Week 1 Portfolio Update - Practicing Progressive Exposure

Fed Decision. Earnings. Mixed Messages. Panic. Rally.

It has been an interesting time to start an account challenge.

If you are an active trader, you are well aware of the volatile environment we are currently seeing.

The market was hoping for a surprise rate cut but didn’t get one. Last week closed very weak.

Monday saw huge gap downs and the biggest spike in the VIX since the COVID crash. Leading stocks rallied hard off the bottom, Oops reversals abounded, and the VIX came crashing back down on Tuesday.

Luckily I am practicing progressive exposure and my account has seen “merely flesh wounds”.

What Is Progressive Exposure?

Progressive exposure is a phrase coined by the legendary Mark Minervini. Progressive exposure is essentially letting your most recent trading results dictate your position size going forward.

It is “dipping your toe” in the market until your account gets traction, then sizing up after you have seen some profits.

This keeps you trading at your largest when you are trading well and trading at your smallest when trading poorly. Minervini is not the only Market Wizard who has practiced this concept, though he was the first to coin this particular phrase and perhaps has taken it to a more systematic level.

How I’m Practicing Progressive Exposure

I will be taking smaller positions (from 6%-12.5%) until I get some wins. I will not go over 25% exposure until I get some wins. I may take one 25% position at once in the beginning if I see a great setup but I will not ramp up my overall exposure to 50-100% until I see some wins and book some gains.

Trading Activity

The first trade I made was in CRNX. The plan was to build up to a 12.5% position with 2 buys.

B1 (Buy 1) would be above the 7/29 high at 54.83. This is cheating a little bit and was probably early. Also the reason I was starting with only a 6.5% position.

B2 would be above the the pivot at 55.78.

B1 Triggered and the stock reversed shortly after clearing the pivot.

Buying in pieces kept me at just a small loss (0.3% of equity)

Trade Stats:

Position Size: 6.5%

Position P&L: (5.1%)

Equity P&L: (0.03%)

My 2nd Trade

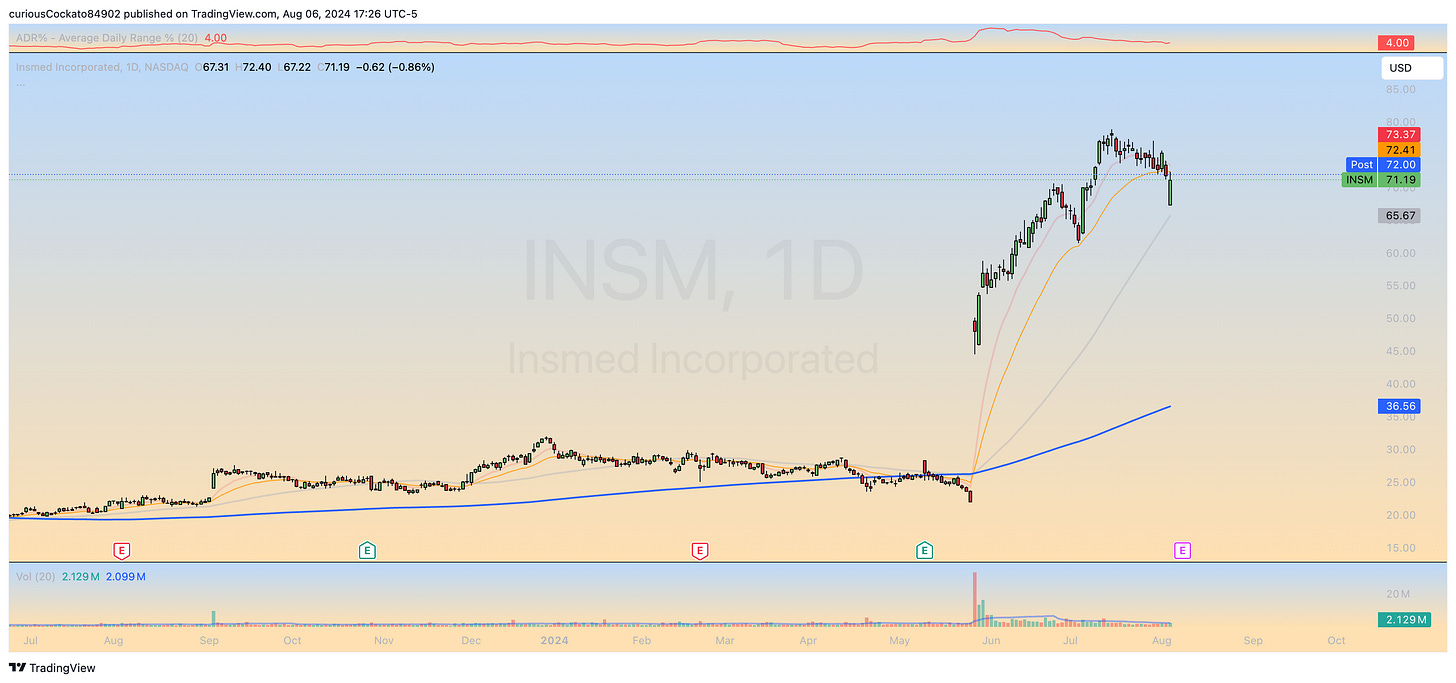

My 2nd trade was in INSM. Setup was a simple bull flag into the 21 EMA.

I purchased on a break above the previous day high and planned on selling if it had a week close. Stop below the 7/31 low at 71.93.

As you can see, the buy triggered:

…but gapped down and stopped me out the next day. Saved me a lot of stress though. INSM would gap down big the next day with the rest of the market. Yes, with the benefit of hindsight, we can see it rallied hard on the open Monday but good luck holding through that gap down.

Trade Stats:

Position Size: 13.7%

Position P&L: (3.8%)

Equity P&L: (0.05%)

Account Stats to Date:

Starting Account Value: $30,000

W/L Record: 0-2

Account % P&L: (0.08%)

Current Account Value: $29,741

Open Trades:

Started a trade in DHI today. I would call this an oops reversal continuation.

Opened the trade at $175.35. Stop at $166.88

More on this trade later.

Remember to respect risk, always use stops, do your own research, and never follow anyone blindly into a trade.